As promised (broken up into two parts due to word count limits) (sources posted below)

Help, I've stumbled into a wormhole and I can't get up. I am in way over my head with this stuff, but I find it incredibly interesting. It's something I will continue to look into, but here's my best crack at this right now.

My initial argument was something along the lines of "Seems like a good time to own assets and a bad time to not own assets." Of course, young people don't own as many assets. That's normal and just a factor of being young. However, having a high cost of entry like we have now will prevent many young people from accumulating them as easily. The assets vs no assets discussion is related to generations, but also goes well beyond that into growing class divide and inequality.

I want to be clear that I'm not saying woe is me life is so hard for us young people. We're Americans, living in America. We have opportunities that would never be afforded to most people on this planet. Ultimately, I am incredibly grateful. My only point is that it's hardER. Not hard. I'm not comparing my lot in life to those who lived through The Weimar Republic or The Great Depression, and insistences that I'm just a young person that likes to complain because young people complain are, as we call it in the Liberal Arts world, ageist.

Let's first talk about the Economist article that almost gave me a brain aneurysm. You would expect a well written article from The Economist, but it's basically all cherry picked stats and the most insane conjecture I've seen in awhile. The article ponders why if Gen Z is so poor, then how can so many of them attend an Olivia Rodrigo concert and buy a $50 T-Shirt, never stopping to ask itself if the kids themselves actually purchased the tickets. The article portrays the Gen Z phenomenon of "Quiet Quitting" as a good thing, showing how Gen Z is hacking the work place and getting more bang for their buck, instead of recognizing it for the symbol of nihilistic culture rot that it actually is ("giving up on work is good actually"). It also has the wonderfully transphobic sentence "They are more likely to be depressed or say they were assigned the wrong sex at birth." And this: "Global house prices are near all-time highs, and graduates have more debt than before. In reality, though, Gen Z-ers are coping because they earn so much. In 2022, Americans under 25 spent 43% of their post-tax income on housing and education, including interest on debt from college."

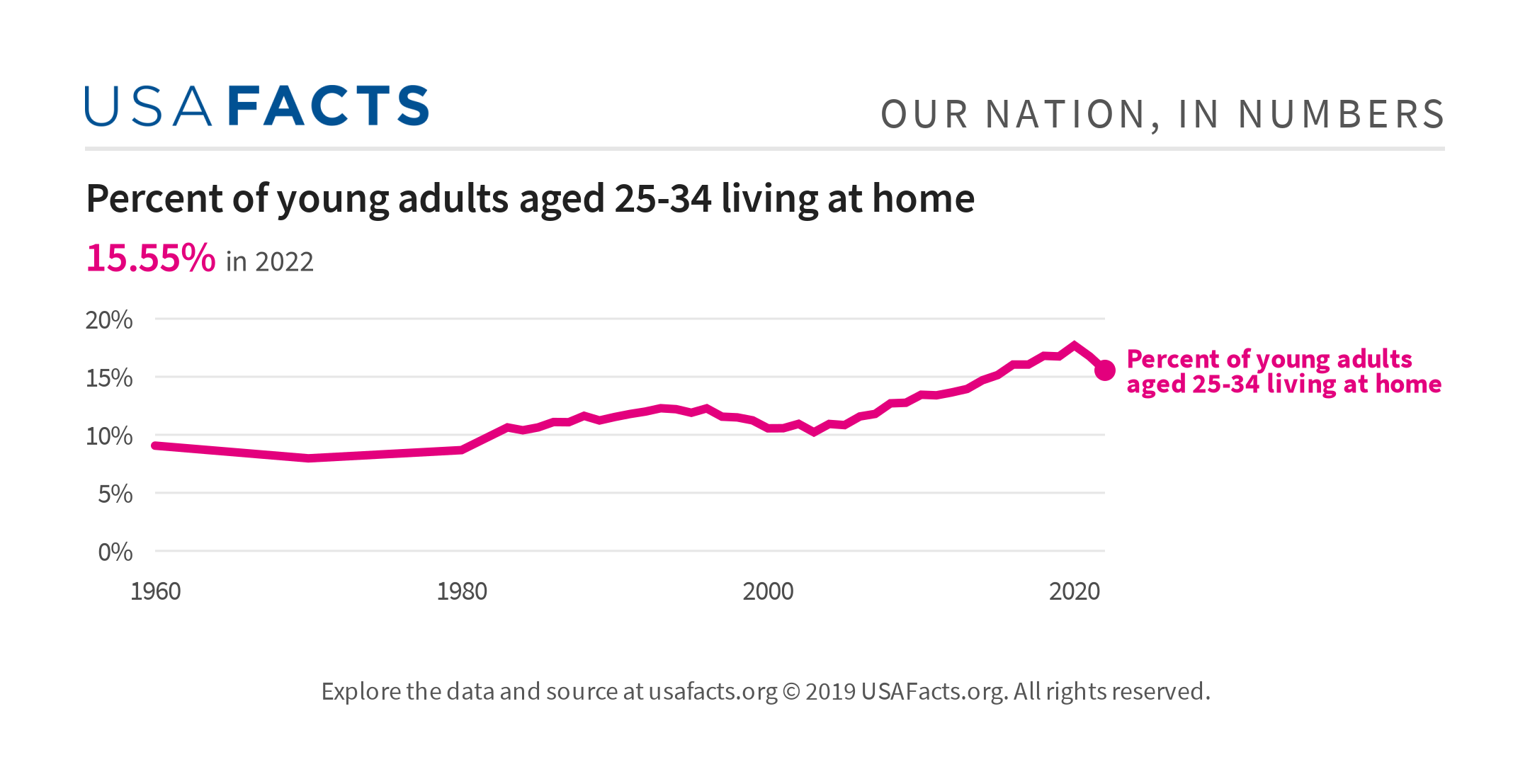

New paragraph because I have to rant about this sentence and it's good writing to break up your paragraphs don't ya know. It's giving the "fellow kids" meme. Gen-Zers are coping because they earn so much money. Not only does that simply not make logical sense, it's incredibly demeaning and cringe. The stat itself is stupid too. The fact that young people are spending less on housing is because they aren't leaving their parent's houses at much higher rates, I would guess because housing is more expensive. The charts vary in how much it's changed, but the chart I'm looking at right now has roughly 8% of people 25-34 living at home in the 1970s and about 17% of the same cohort living at home now. So yeah it would be quite surprising if the stats weren't affected by a more than 100% jump in the cohort not paying a dime for housing.

So let's talk about houses. The American Dream, right? Agip says that people should just rent and invest in other increasing assets while this whole thing blows over. That's probably good advice. Rent skyrocketed (roughly 25% increase in the last 5 years according to one source), but not nearly as much as housing. But just because you should rent and save doesn't make it any less crappy of an outcome. The importance of owning a home vs renting, and the control you have over it as a result, cannot be overstated. Obviously you build equity on the most expensive asset most people own, but beyond that, you have the control to make changes and aren't subject to landlords or apartment complexes. This part is purely my opinion, but modern apartment complexes are very, very crappy. Your neighbors are crappy and can make a lot of noise with no repercussions. Your parking situation will probably be crappy. Your maintenance situation almost certainly will be crappy. You have to spend a decent chunk of money to be in a safe part of town, and complexes extending far into the suburbs are not necessarily cheaper, at least in Atlanta where I have the most knowledge of the market. You might have roaches, etc. Being able to control your environment is important, especially when you are considering starting a family and need a safe and quiet place to do so. But I'm sure you had to deal with roaches and poor electricity in the 70s so I digress.

But Hunter, the stats show that Gen Zers actually own homes at higher percentages than Millennials did! These stats are online everywhere, and they are misleading. The stat holds if you look at what the census calls "homeownership rate", which is not simply the number of Gen Z homeowners divided by the total number of Gen Zers. It is true that many Gen Zers became homeowners during the 2020-2021 time period when rates were low, but they still trail behind older generations. The graph I have has them at 18% with Boomers coming in at a little over 30% at the same age. When you look at the median age of first time home buyers, it checks out, going from 29 to 35 between 1981 and 2023.

There's also the issue with how much these numbers are affected by parental support. According to surveys, roughly 40% of Gen Zers are receiving financial help from their parents for renting or purchasing a home. The data doesn't exist for this number in the 1970s from what I can tell. In my anecdotal experience, my Fiancé's dad helped with the initial purchase on our condo by supplying the $30k down payment. My republican best friend that I talk about all the time had a much sweeter deal where his parents bought him a $575k home in cash (Stephen you b4st4rd) and now he counts as a Millennial homeowner (he does pay them monthly but at a heavily subsidized rate). Another couple in our group of friends was donated several acres to build a house on by one of their fathers, who wants everyone to live on his land and have a big Christian family estate thing that I find weird but endearing. Again, it's hard to truly know how much this has changed, but there are good stats showing that Gen Zers have better relationships with their parents than generations before and some websites claim parental support percentages are "increasing" but there's no graph or anything. It's easy to imagine though, some financially acute and well off parents, noticing the low rates in 2020-2021 and figuring it would be the best time to help their freshly graduated 22 year old buy an apartment. It's the financially savvy move and these people are financially savvy. All of the people I just talked about were well off to begin with.

The stats of course coincide with families deciding to have children later in life, citing home ownership costs and economic considerations as top reasons. Culture plays a part too, and some people say the drop in replacement rate is a good or fine thing, and others like Elon Musk say it's VERY BAD. Weddings are also more expensive (adjusted for inflation of course). Like I said before, Mortgage or Marriage exists now. This is less stats based (although the stats do show it's more expensive) and more vibes based but I don't think Mortgage or Marriage should be thing. Dystopian garbage imo. However, it's a very real consideration for some friends of ours, who were given $30k by their parents and had to decide whether to put a down payment on a house or have a wedding. They'll be having a wedding.

But let's get back to the The Economist article I hate so much because the underlying data is most important to our discussion. The foundational data for the worst article I've ever read is a paper by Kevin Corinth and Jeff Larrimore titled "Has Intergenerational Growth Stalled? Income Growth Over Five Generations of Americans." It's 58 pages and I popped a 10mg Adderall to get through it (there's a few pages of references and graphs so I'm no hero). The basic summary is that adjusted for inflation using the PCE Index and also checking it with the CPI-U-RS Index to verify their results, they found that there has always been intergenerational growth in wages that is slowing down over time. The Silent Generation experienced 34% growth, Boomers 27%, Gen-X 16%, Millennials 18%. No Gen-Z calculations yet. They attribute this slowdown to a lack of growing work hours, I imagine due to women entering the work force thus increasing median wages in the 1970-90s. The Economist article summarizes the findings for Gen-Z saying, "The typical 25-year-old Gen Zer has an annual household income of over $40,000, more than 50% above baby boomers of the same age."

The stats in the graph are of course not effected by college tuition costs. It has a small chart showing that Baby Boomers paid roughly $7,800 a year for room and board at school while Millennials would pay roughly $20k (inflation adjusted of course). The article argues that the gains Millennials have made in income will far outweigh, over a longer period of time, the cost of college. It does caveat by saying "Nevertheless, young adults may also not feel the benefits of these gains early in their career, due to the timing of the student loan repayments. A $38,0000 student loan at 6% interest with a typical 10-year repayment term would require annual payments of $5,000." So taking everything else in this article at face value, Millennials were still set back in their early earning years when they would most likely want to start families and buy houses. This is directly from the paper.

Even so, I will not take the article at face value, for I have discovered the wonderful world of inflation indexes. It honestly has my head spinning. This is what I was referring to when I said this was above me but I'm fascinated. So for starters, neither the PCE or CPI take into account mortgage payments when calculating inflation. They use the rental value only, so if you're paying $4,000 a month on a mortgage, but your house is deemed rentable at $2200 (anyone who uses Zillow as much as I do knows this is the norm right now), the PCE and CPI will calculate inflation based on the $2200 number. So basically the whole mortgage housing boom we've seen the last few years is only accounted for in common inflation indexes as much as it's increased rent values. It would take some complicated math and data parsing to know what effect this would have on the data showing Gen Z is making more money, but I think it's important to point out that the largest increasing cost young people face is literally not factored in all the way into the inflation index being used. This is just the first problem with inflation indexes.